Company: HSBC

Designation: Business Analyst

Year of Experience Required: 0 to 4 years

Technical Expertise: SQL, Python/R, Statistics, Machine Learning, Case Studies

Salary Range: Competitive, based on experience

HSBC, a multinational investment bank headquartered in the United Kingdom, operates in over 65 countries and is one of the most trusted names in the banking sector. Known for its robust financial systems and data-driven decision-making, HSBC is a great place to work as a Business Analyst. If you’re preparing for a Business Analyst role at HSBC, here’s a detailed breakdown of their interview process and the types of questions you can expect.

HSBC Business Analyst Interview Questions

If you are planning for putting up your resume in a HSBC Business Analyst Interview, the following questions will help to succesfully achieve your goal.

Interview Process

The HSBC Business Analyst interview process typically consists of 5 rounds, each designed to evaluate different aspects of your technical and analytical skills:

Round 1 – Telephonic Screening

Focus: Basic understanding of Business Analysis concepts, SQL, and Python/R.

Format: You’ll be asked to explain your projects and solve a few coding or SQL problems.

Round 2 – Walk-in/Face-to-Face Technical Round

Focus: Advanced SQL, coding, and problem-solving.

Format: You’ll solve problems on a whiteboard or shared document.

Round 3 – Project Analysis

Focus: Deep dive into your past projects.

Format: You’ll be asked to explain your approach, tools used, and the impact of your work.

Round 4 – Case Studies

Focus: Business problem-solving and data-driven decision-making.

Format: You’ll be given a real-world scenario and asked to propose solutions.

Round 5 – Hiring Manager Round

Focus: Cultural fit, communication skills, and long-term career goals.

Format: Behavioral questions and high-level discussions about your experience.

Difficulty of Questions

SQL – 8/10

1) How can you find customers who have placed orders in both 2023 and 2024?

SELECT customer_id

FROM orders

WHERE YEAR(order_date) IN (2023, 2024)

GROUP BY customer_id

HAVING COUNT(DISTINCT YEAR(order_date)) = 2;2) How can you calculate the average value of orders placed by each customer?

SELECT customer_id, AVG(total_value) AS avg_order_value

FROM (

SELECT customer_id, order_id, SUM(price * quantity) AS total_value

FROM order_details

GROUP BY customer_id, order_id

) AS order_totals

GROUP BY customer_id;

3) How can you find products that were ordered in the last 7 days?

SELECT DISTINCT product_id

FROM order_details

WHERE order_date >= CURDATE() - INTERVAL 7 DAY;4) How do you determine the most frequently ordered quantity?

SELECT quantity, COUNT(quantity) AS count

FROM order_details

GROUP BY quantity

ORDER BY count DESC

LIMIT 1;5) How can you find employees who were hired in the same month?

SELECT MONTH(joining_date) AS month, GROUP_CONCAT(name) AS employees

FROM employees

GROUP BY MONTH(joining_date)

HAVING COUNT(*) > 1;🚀 Master MySQL Interviews! Get expert answers to all MySQL interview questions in one power-packed eBook. – 550 SQL Interview Questions to crack Any Analytics Interview.

R/Python – 7/10

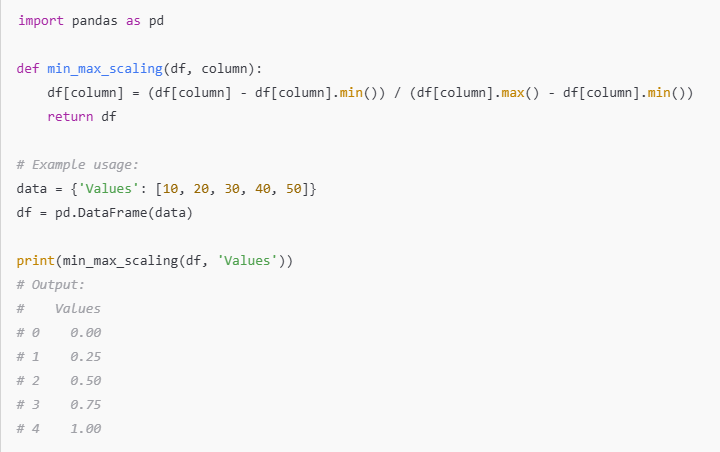

1) Write a Python function to normalize a column in a Pandas DataFrame using Min-Max Scaling.

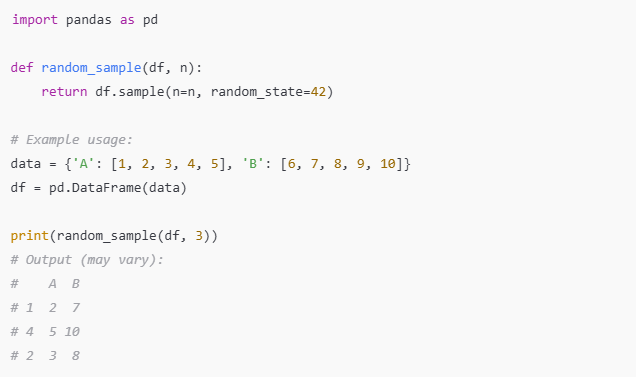

2) Write a Python function to randomly sample n rows from a Pandas DataFrame without replacement.

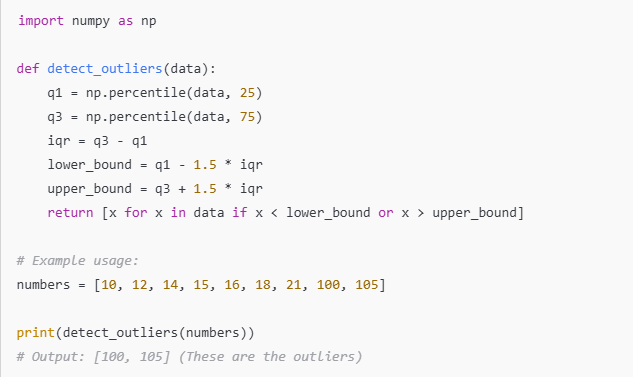

3) Write a Python function to find outliers in a list of numbers using Interquartile Range (IQR).

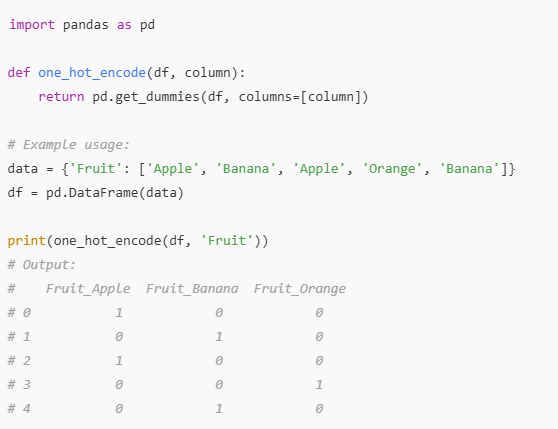

4) Write a Python function to one-hot encode a categorical column in a Pandas DataFrame.

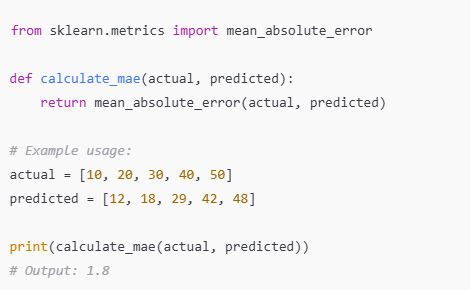

5) Write a Python function to compute the Mean Absolute Error (MAE) between two lists of numbers.

🚀 Become a Full Stack Analytics Pro! Get the ultimate guide to mastering analytics and landing your dream job. Grab your copy now! -> 2200 Most Asked Analytics Interview Questions

Statistics/ML

1) Difference Between L1 and L2 Regularization

Regularization prevents overfitting by adding a penalty to model weights:

- L1 Regularization (Lasso Regression) – Adds an absolute value penalty (

|w|), leading to sparse weights (feature selection). - L2 Regularization (Ridge Regression) – Adds a squared penalty (

w²), preventing large weights but keeping all features. - Key Difference – L1 reduces some coefficients to zero (feature selection), while L2 shrinks coefficients but retains all features.

2) What is the Curse of Dimensionality?

As dimensionality increases, data becomes sparse, affecting model performance:

- Effects – Distance-based algorithms (e.g., KNN, clustering) lose effectiveness, and models become more prone to overfitting.

- Solution – Use dimensionality reduction techniques like PCA, t-SNE, or feature selection methods to retain only relevant features.

- Example – In a high-dimensional space, nearest neighbors become equally distant, making KNN unreliable.

3) Difference Between Parametric and Non-Parametric Models

Machine learning models can be categorized based on how they learn from data:

- Parametric Models – Have a fixed number of parameters, assume a specific data distribution, and are computationally efficient (e.g., Linear Regression, Logistic Regression, Naïve Bayes).

- Non-Parametric Models – Do not assume a fixed number of parameters, can capture complex patterns, and require more data (e.g., Decision Trees, KNN, SVM).

- Key Tradeoff – Parametric models are faster but less flexible, while non-parametric models handle complex data better but need more computation.

4) What is the Difference Between Hard and Soft Margin SVM?

Support Vector Machine (SVM) classifies data by maximizing margin:

- Hard Margin SVM – Allows no misclassifications; works only when data is perfectly linearly separable.

- Soft Margin SVM – Allows some misclassification by introducing a penalty term (C); useful for real-world noisy data.

- Key Tradeoff – Hard margin ensures perfect separation but is sensitive to noise, while soft margin improves generalization.

5) Steps to Handle Imbalanced Data in Classification

Imbalanced datasets can lead to biased models favoring majority classes. Solutions include:

- Resampling – Use oversampling (SMOTE) or undersampling to balance classes.

- Class Weight Adjustment – Assign higher weights to minority class during training.

- Anomaly Detection – Treat rare class detection as an outlier problem.

- Evaluation Metrics – Use Precision-Recall, F1-score, AUC-ROC instead of accuracy.

- Algorithm Choice – Use ensemble methods like Random Forest, XGBoost with class balancing techniques.

🚀 Crack Any ML Interview! Get 1,200 Machine Learning Interview Questions in one ultimate eBook. Boost your confidence and ace your next interview! – Machine Learning 1200 Interview Questions

Case Study

Problem Statement:

HSBC wants to improve its loan approval process by predicting which customers are at higher risk of defaulting on their loans. Your task as a Business Analyst is to analyze customer loan data, identify risk factors, and propose strategies to reduce loan defaults.

Dataset Overview:

You have access to a dataset containing historical loan applications and customer financial details. The dataset includes:

- Customer_ID – Unique identifier for each customer

- Age – Customer’s age

- Income – Monthly income of the customer

- Loan_Amount – Loan amount requested

- Credit_Score – Customer’s credit rating

- Employment_Status – Whether the customer is employed, self-employed, or unemployed

- Debt-to-Income Ratio – Ratio of total monthly debt payments to monthly income

- Loan_Term (months) – Duration of the loan

- Previous_Loan_Default – 1 if the customer has defaulted on a past loan, 0 if not

- Loan_Status – 1 if the customer defaulted, 0 if they repaid successfully

Key Questions to Answer:

1. What factors influence loan default risk?

- Do low credit scores lead to higher default rates?

- How does employment status impact a customer’s ability to repay loans?

- Is there a correlation between high debt-to-income ratio and loan defaults?

2. How can HSBC improve its loan approval process?

- Can HSBC implement stricter approval criteria for high-risk customers?

- Should HSBC offer personalized loan terms based on customer risk levels?

- How can HSBC use predictive analytics to assess creditworthiness?

3. How can HSBC reduce loan defaults while maintaining profitability?

- Should HSBC adjust interest rates for high-risk customers?

- Can HSBC introduce financial advisory services for at-risk customers?

- How can HSBC enhance customer education on responsible borrowing?

Key Insights & Business Recommendations

1. Identifying Loan Default Risk Factors

- Credit Score is a Key Predictor: Customers with credit scores below 600 have a significantly higher probability of defaulting. HSBC should consider stricter credit score requirements for loan approvals.

- Employment Stability Matters: Self-employed or unemployed individuals have higher default rates. HSBC should require additional financial verification for these customers.

- Debt-to-Income Ratio Impacts Repayment Ability: Customers with a debt-to-income ratio above 40% are at higher risk of default. HSBC can use this metric as a screening criterion.

2. Improving HSBC’s Loan Approval Process

- Implement Risk-Based Loan Pricing: HSBC can offer lower interest rates to low-risk borrowers and higher rates for high-risk customers to balance risk and profitability.

- Use Predictive Analytics for Credit Assessment: HSBC should leverage AI models to predict default probabilities and provide real-time risk scores during loan applications.

- Enhance Loan Application Screening: HSBC should introduce a more detailed financial assessment for customers with past loan defaults before approving new loans.

3. Strategies to Reduce Loan Defaults

- Financial Literacy Programs: HSBC can educate customers on debt management and responsible borrowing through online resources and counseling.

- Flexible Repayment Plans: Offering customized repayment plans for customers facing financial difficulties can reduce defaults.

- Early Warning System for High-Risk Customers: HSBC can proactively monitor customer financial health and intervene before they default.

🚀 Basic, you can practice a lot of case studies and other statistics topics here –

https://thedatamonk.com/data-science-resources/

🚀 Get The Data Monk 23 eBook Bundle covering everything from ML to SQL. Your all-in-one prep for cracking any interview! -> The Data Monk 23 e-book bundle 📚

The Data Monk services

We are well known for our interview books and have 70+ e-book across Amazon and The Data Monk e-shop page . Following are best-seller combo packs and services that we are providing as of now

- YouTube channel covering all the interview-related important topics in SQL, Python, MS Excel, Machine Learning Algorithm, Statistics, and Direct Interview Questions

Link – The Data Monk Youtube Channel - Website – ~2000 completed solved Interview questions in SQL, Python, ML, and Case Study

Link – The Data Monk website - E-book shop – We have 70+ e-books available on our website and 3 bundles covering 2000+ solved interview questions. Do check it out

Link – The Data E-shop Page - Instagram Page – It covers only Most asked Questions and concepts (100+ posts). We have 100+ most asked interview topics explained in simple terms

Link – The Data Monk Instagram page - Mock Interviews/Career Guidance/Mentorship/Resume Making

Book a slot on Top Mate

For any information related to courses or e-books, please send an email to [email protected]